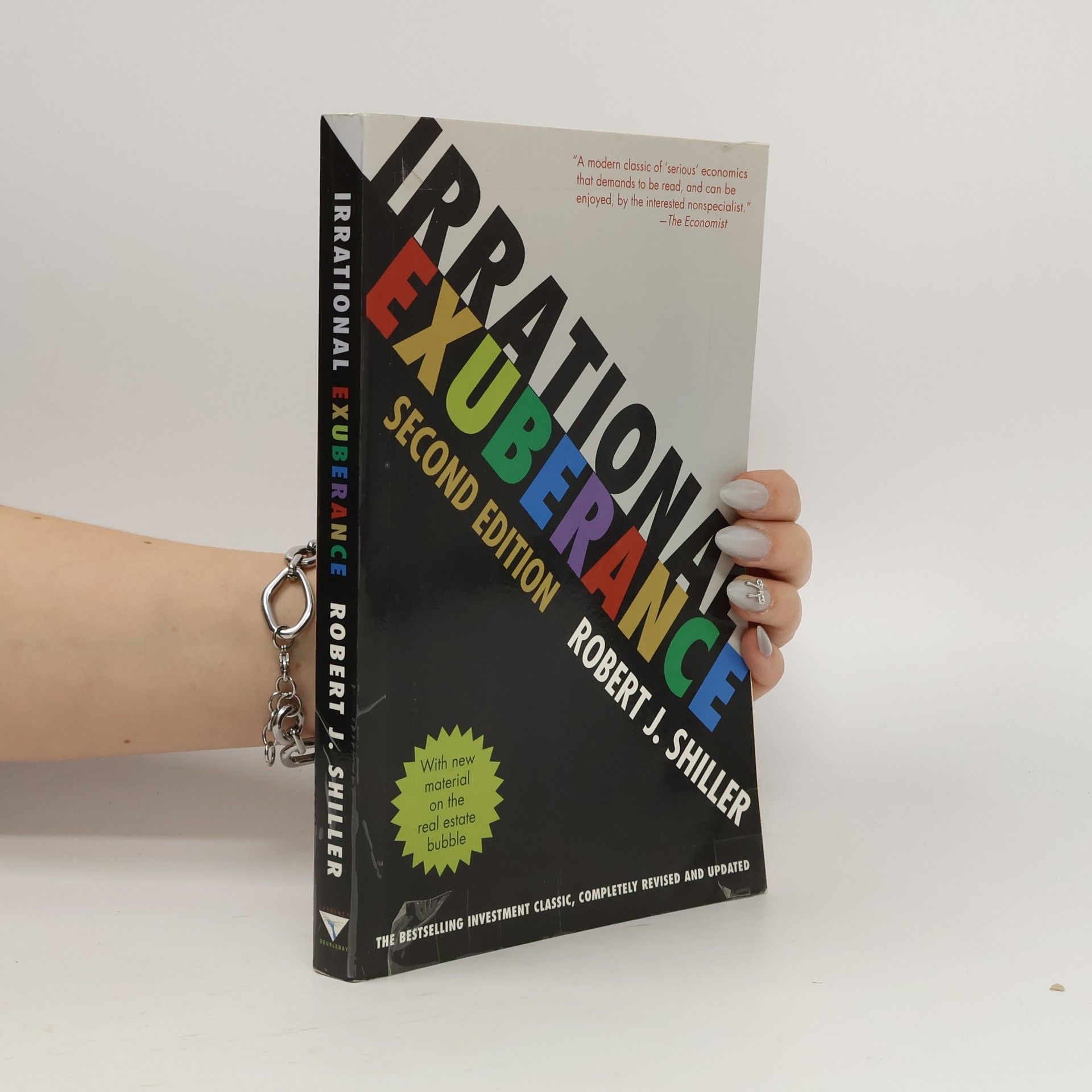

Irrational Exuberance

Second Edition - With New Material on the Real Estate Bubble - The Bestselling Investment Classic, Completely Revised and Updated

- 304bladzijden

- 11 uur lezen

In the 2009 preface to his classic work on behavioral economics and market volatility, Robert Shiller reflects on the economic crisis that has emerged, likening it to the Great Depression. As Americans and investors navigate the aftermath of a bubble economy, Shiller's insights and warnings are crucial. The original 2000 edition of this book highlighted Alan Greenspan's 1996 remark about "irrational exuberance" in the stock market, predicting the tech stock bubble's collapse by examining the structural, cultural, and psychological factors behind unsustainable price growth. The 2005 second edition expanded this analysis to real estate, presenting evidence of dangerously inflated housing prices and warning of potential bankruptcies and a global recession. These predictions proved accurate, leading to the significant economic fallout addressed in the 2009 preface. This work remains an essential, thought-provoking analysis that anyone with financial interests in any market should read and consider seriously.