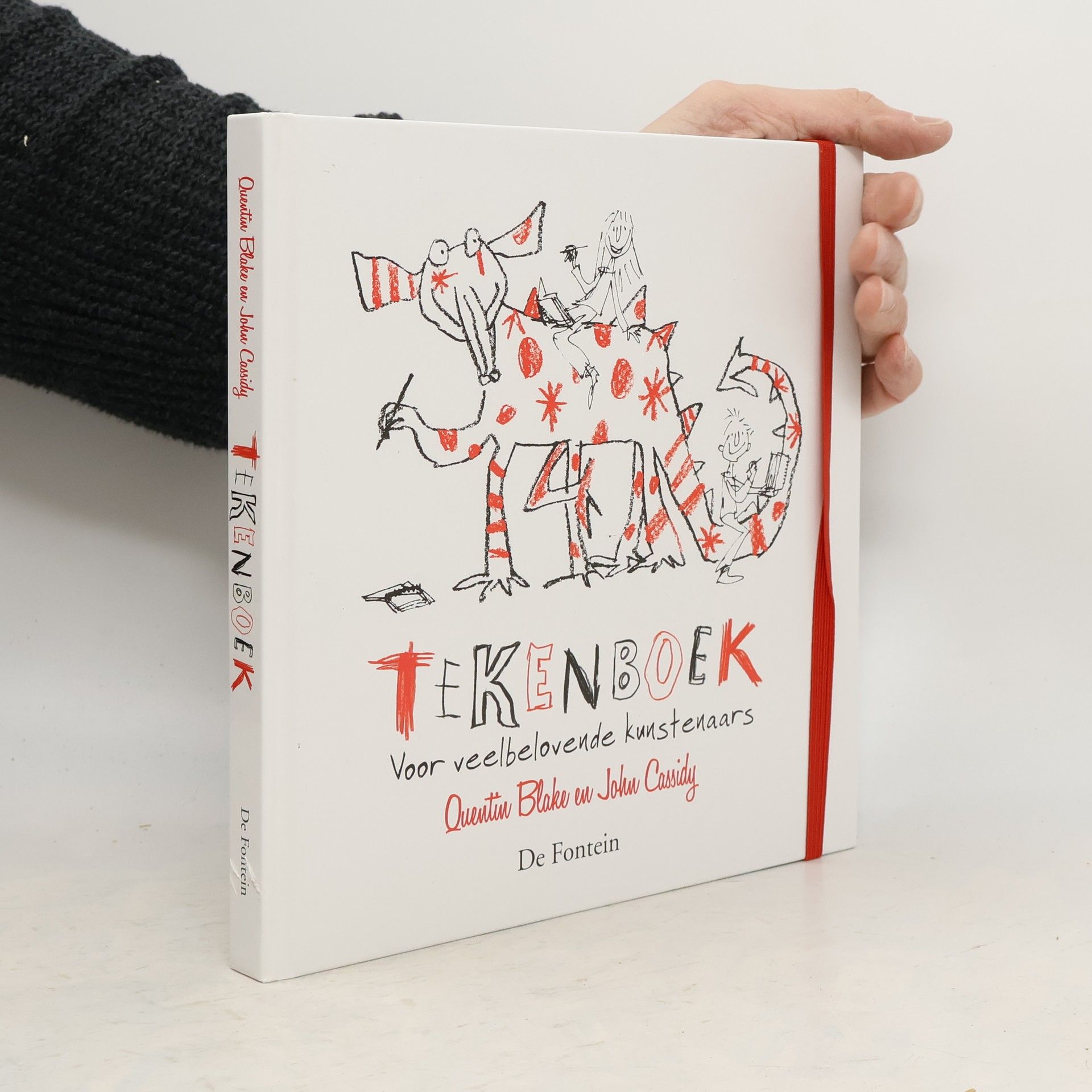

Tekenboek voor veelbelovende kunstenaars / druk 2

- 103bladzijden

- 4 uur lezen

John Cassidy is een journalist die schrijft over economische en politieke onderwerpen. Zijn werk richt zich vaak op financiële markten en hun impact op de samenleving. Cassidy's stijl staat bekend om zijn analytische diepgang en zijn vermogen om complexe kwesties duidelijk uit te leggen. Zijn schrijven biedt lezers een indringende kijk op de moderne economie.

Kritische analyse van het idee van de vrijemarkteconomie en de opkomst en ondergang daarvan in het licht van de huidige economische crisis.

Veteran New Yorker staff writer John Cassidy offers a provocative take on the misguided economic thinking that produced the 2008 financial crisis—now with a new preface addressing how its lessons remain unheeded in the present, as we're facing the worst economic catastrophe since the Great Depression. A Pulitzer Prize Finalist An Economist Book of the Year A Businessweek Best Book of the Year For fifty years, economists have been developing elegant theories or how markets facilitate innovation, create wealth, and allocate society's resources efficiently. But what about when they fail, when they lead us to stock market bubbles, glaring inequality, polluted rivers, and credit crunches? In this updated and expanded edition of How Markets Fail, John Cassidy describes the rising influence of "utopian economies"—the thinking that is blind to how real people act and that denies the many ways an unregulated free market can bring on disaster. Combining on-the-ground reporting and clear explanations of economic theories Cassidy warns that in today's economic crisis, following old orthodoxies isn't just misguided—it's downright dangerous.

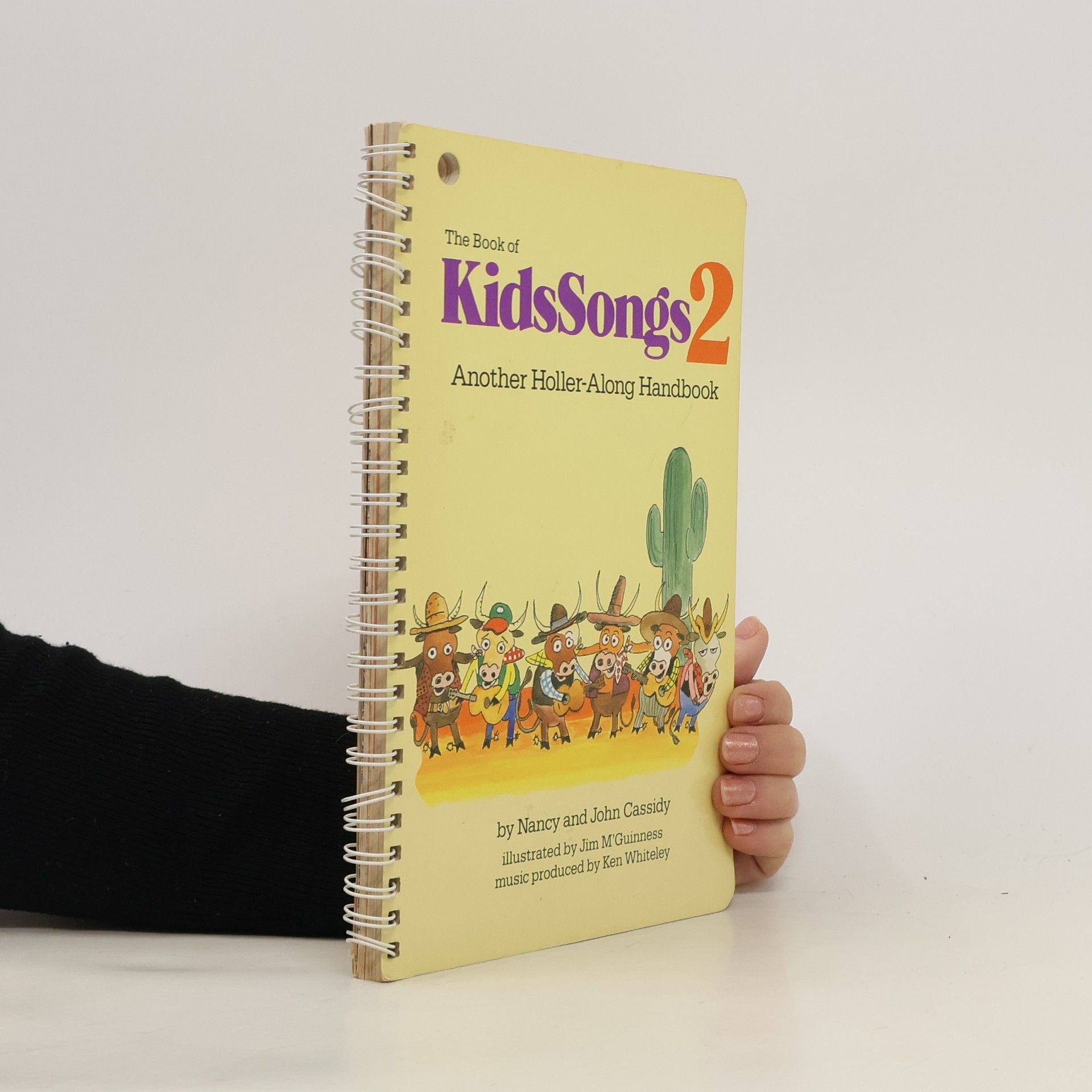

The classic holler-along music collection for ages four to forever. We've sold over a million copies of these recordings, and they still get more out-of the-blue raves and crayon-drawn endorsements than most anything else we do. Nancy Cassidy's Gold-Record-winning tunes are available on cassettes packaged with beautifully illustrated books of lyrics and music, or all by themselves on compact disc.

How Markets Fail Logic of Economic Calamities. Farrar, Straus and Giroux, 2009.

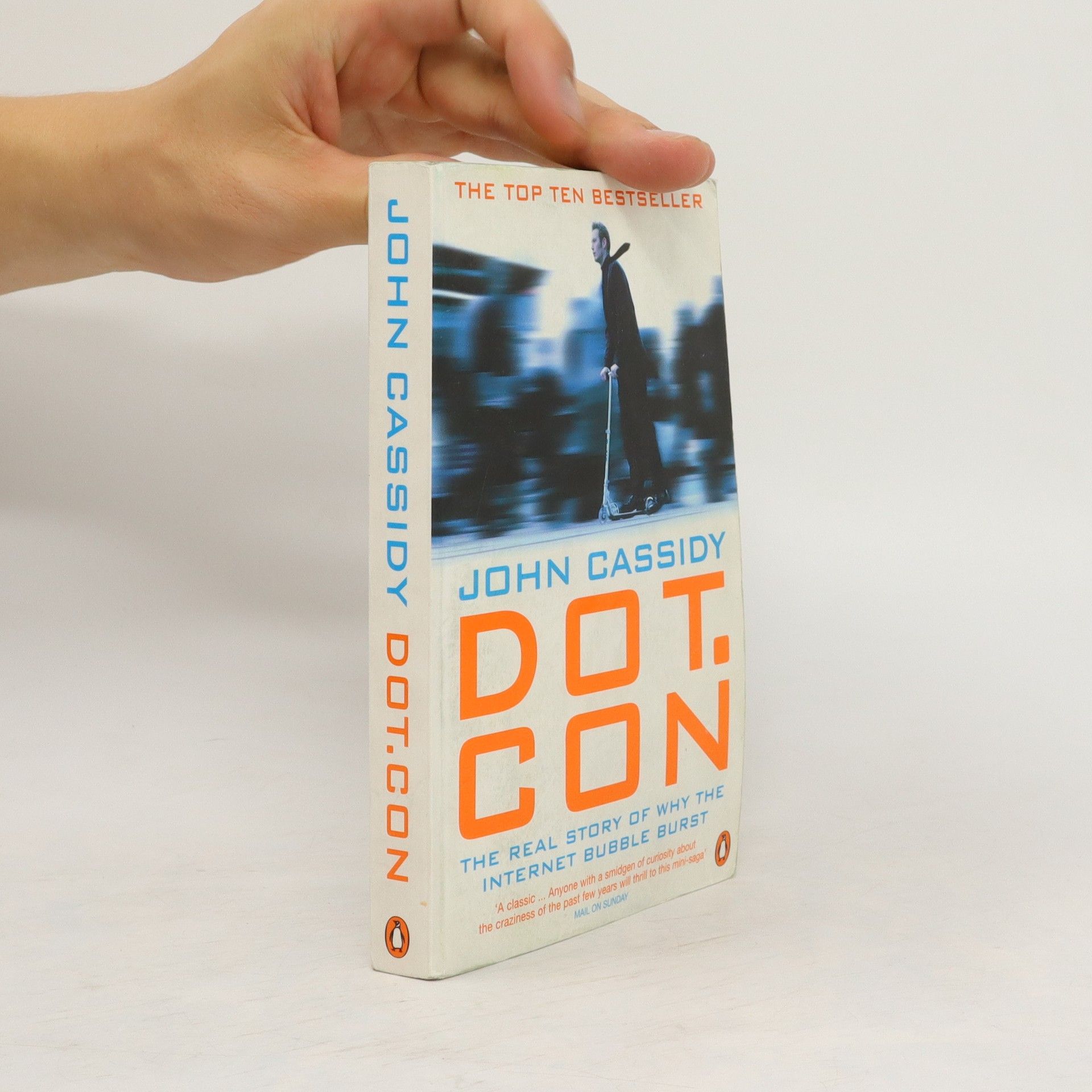

This is a sceptical history of the internet/stock market boom. John Cassidy argues that what we have just witnessed wasn't simply a stock market bubble; it was a social and cultural phenomenon driven by broad historical forces. Cassidy explains how these forces combined to produce the buying hysteria that drove the prices of loss-making companies into the stratosphere. Much has been made of Alan Greenspan's phrase irrational exuberance, but Cassidy shows that there was nothing irrational about what happened. The people involved - fund managers, stock analysts, journalists and pundits - were simply acting in their own self-interest.

Learn how to juggle with this amusing how-to book.

The Klutz Book of Animation is a complete how-to treatment of stop-motion magic, from practical instruction to ready-to-shoot scripts. The software you Have fun

In 1945, Vannevar Bush, Franklin D. Roosevelt's chief scientific adviser, envisioned a desktop computer that would house all human knowledge, inspiring the scientists who later built the Internet. The early 1990s saw a transformation of the Internet from a scientific curiosity into a massive gold rush, thanks to the British programmer who created the World Wide Web and an Illinois student who developed a user-friendly browser. John Cassidy, a leading financial journalist, recounts the stories of Netscape, Yahoo!, America Online, and Amazon.com, among others, in a vibrant narrative that explores the rise of Internet stocks and a new stock market culture following the Cold War. He illustrates how a coalition of entrepreneurs like Jeff Bezos, venture capitalists, stock analysts, and investment bankers turned a groundbreaking technological advancement into a volatile speculative bubble. Cassidy also highlights the role of journalists and policymakers, notably Alan Greenspan, in prolonging this bubble. Ultimately, he argues that the responsibility for the Internet boom and bust is collective, involving millions of Americans. Now, the nation faces the consequences of its greed and wishful thinking. Blending storytelling, history, and economics, Cassidy provides a comprehensive account of this significant financial saga.